[vc_row][vc_column][vc_column_text]

The price of houses in the GTA keeps climbing and they aren’t coming back down anytime soon

By Arpita Quadir

Mohammed Shahed is a 26-year-old first-time home buyer in Toronto. He has saved up enough money for a down payment, understands his mortgage options and managed to get it pre-approved. Shahed has a great realtor and he is ready to start looking. Everything was aligned for him to buy his first house, but eight months later, he still hasn’t found a place to call his home.

“It’s been hard,” said Shahed. “Walking into an open house from week to week is challenging when the result is the same every time.” He finds a house that he likes and then puts down his best offer, but in the end, he is always outbid. At first, looking for a house was an exciting experience, he said, but now he feels disappointed.

Shahed moved to the city in 2014 with a student visa to study engineering. He currently works at a manufacturing company as an engineer. Although he lives by himself, he hopes to one day start a family, so he is looking for space to grow. He says it’s difficult for him to talk to his co-workers about houses because most of them are already homeowners with families of their own. He envisions a similar life for himself one day, but the market is too competitive for him to begin that chapter of his life.

Shahed began his search in early 2021. He is looking to relocate outside of the city, around Cambridge and Guelph to be close to his work but looking outside of the city hasn’t provided him with much luck so far. He is willing to commute to work if it means being able to find a home.

All types of houses on the market are selling for $100,000; $200,000; sometimes 1 million over the asking price. (ARPITA QUADIR/Piktochart)

The housing crisis has created an especially challenging market for lower to middle-class families. A large portion of the population in Toronto lives below the poverty line, according to the Toronto Poverty Reduction Strategy report from 2021. But even those who are fortunate to afford a home can’t buy one, making nearly half the population in Toronto renters.

According to Listing.ca, in 2021, the average house in the GTA ranged from $647,306 to $1,215,205, depending on the type of house and area. But with the current bidding craze and competition, the price of a house is higher than the average.

When wages don’t match what a house costs. It’s about the cost of living and wages remaining stagnant for more than a generation, according to Generation Squeeze, a research and activist group. If wages kept up with inflation, and if elected officials imposed a responsible housing policy, purchasing a home would not be so far out of reach for so many people.

There’s an important role for policy-makers, especially with both provincial and municipal elections just around the corner. Jessica Bell, NDP housing critic, was contacted for an interview but was not available.

Buying a house is different for everyone. Dahniel King, a student at the University of Manitoba, has been trying to relocate from Winnipeg to Toronto with her family for more than two years.

The Kings are owners of multiple businesses in the Philippines, which is where the bulk of their household income comes from. They have been pre-approved for a mortgage and started house-hunting two years ago.

Their budget of $1.5 million should in theory open doors for them to buy a home, but with the current market, the experience has been “incredibly difficult,” said King. “Looking for a house for over two years now and still not being able to find a good home within our price range is so frustrating.” The Kings are looking for houses in the surrounding suburbs of the city.

According to a Toronto Housing Market Report from WOWA, the demand for homes is higher in the suburbs surrounding Toronto where the average sale prices have surged from 16 per cent from November 2020 to January 2021. (ARPITA QUADIR/Genially)

The housing crisis is a multifaceted problem, but there are a few clear-cut causes. “Historically, the way we got [affordable housing] in the past is we paid for it,” said Geordie Dent, Executive Director of Metro Tenants Association. The government used to invest billions of dollars between the 1950s and 1990s to build new homes annually, but the money to do that was axed in 1993, which has “put us precisely in the crisis we are in today,” said Dent.

Nurjahan Begum, founder and owner of Progoti Apparel, gave up her hopes of becoming a homeowner back in 2008. She missed her window of opportunity when houses ranged from $300,00 to $400,000. Now she can no longer afford to own a home within the city. “The only way I could afford a house now is to look outside of the city, but that isn’t realistic for me with my business,” Begum explained.

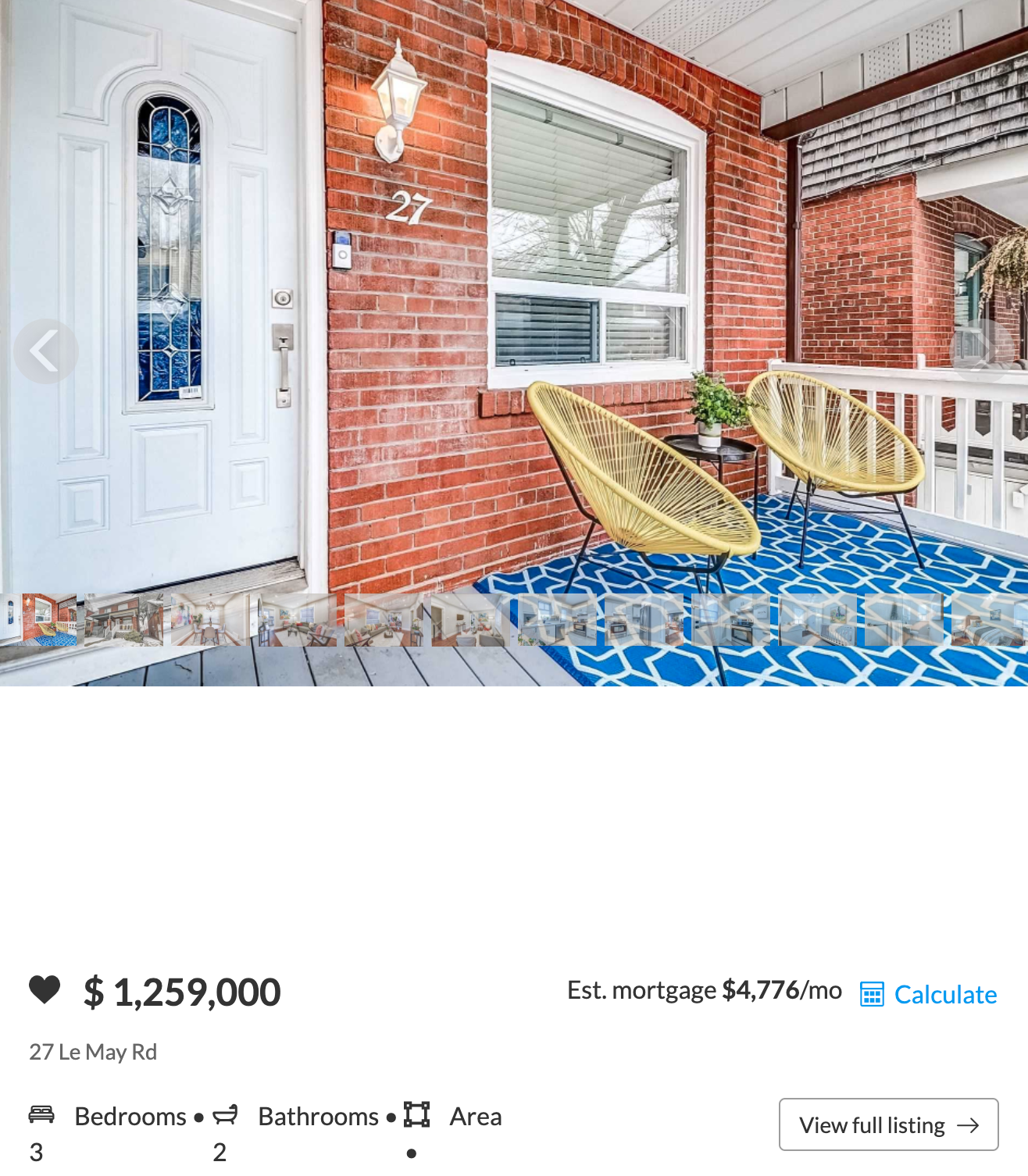

Recent house listings in the GTA. (via Home Search)

Her shop, Ethical Local Market is located at 1628 Queen St. East, requiring her to stay within the city where she can commute to her shop conveniently.

Her experience trying to buy a house in Toronto was horrible back when houses were “affordable,” she said, but now the idea is unfathomable. “There are too many people who want to buy a house and not enough homes to go around to meet that demand,” said Begum. Though she is content renting her apartment in Bayview, the idea of buying a house does cross her mind, but she doesn’t want to consider buying one unless the market becomes more realistic.

Changing the current housing system is necessary. People are living in “fear of rent increases, fear of getting sick and not getting enough hours, fear of needing another job, fear of personal relationships suffering due to always working or being too stressed and angry,” said Tommy Taylor, a Frontline Community & Shelter Worker and Activist about the renting crisis. No one should have to live in fear of not having a home.

[/vc_column_text][/vc_column][/vc_row]